So we had some interest rate cuts - what now?

After holding steady at 5.0% for almost a full year, we received two back to back incremental interest rate reductions in June and July. This certainly helped homeowners and landlords a bit. The two rate hikes would reduce approximately $30 on every $100,000. It's not a lot, but its a start.

Benchmark Housing Price

Benchmark home values fell in every property type in both the Greater Vancouver and Fraser Valley regions between May and June. Between June and July, it was exactly the same story, with the exception of detached homes in the Fraser Valley: the benchmark price for that segment went up by $700 - from $1,528,900 to $1,529,600. In case you're wondering, the benchmark detached home values were up in Abbotsford, nominally in Surrey, but down in Langley. Townhomes and Apartments in both regions fell.

Sales

When it came to sales, we've seen a continuation of the declining trend since April/May, which again, is historically not the case. The only housing type in either region that didn't decline in sales were Fraser Valley townhomes. As we head deeper into summer, this is usually the time that we might have seen sales peak for the year, maybe plateau before falling in September and October. But if we've peaked in April at historically low sales figures, this may be worrying for many home sellers (and certainly the real estate and construction industries). Let's also not forget that when the average sales price in Greater Vancouver is $1.25 million and sales fall from 44,000 units in 2021 to 26,000 in 2023, that's a loss of around $400 million in property transfer taxes for the BC government. That might be a drop in the bucket in an annual budget, but it could hire a few nurses, I'm sure (or 0.8km of the Broadway Subway).

Are Buyers Waiting for Further Rate Reductions?

Despite the slight softening of home values, they are still high enough at today's interest rates to keep many buyers away. Yes, variable mortgages are down $30 per $100,000 since earlier this year, which is a relief for current homeowners, but for those trying to get into the market, or for those looking to upsize, it just isn't an economic reality.

Anecdotal evidence suggests that many people have a lot of doubt about the accuracy of inflation reports. The grocery bills for the average household have skyrocketed well beyond what inflation suggests. These are the types of things that play into the psychology of the average first time homebuyer that drives the market. However, inflation has obviously come under control and home prices aren't rapidly climbing, both of which should lead to a summer of stronger sales, so what else is going on?

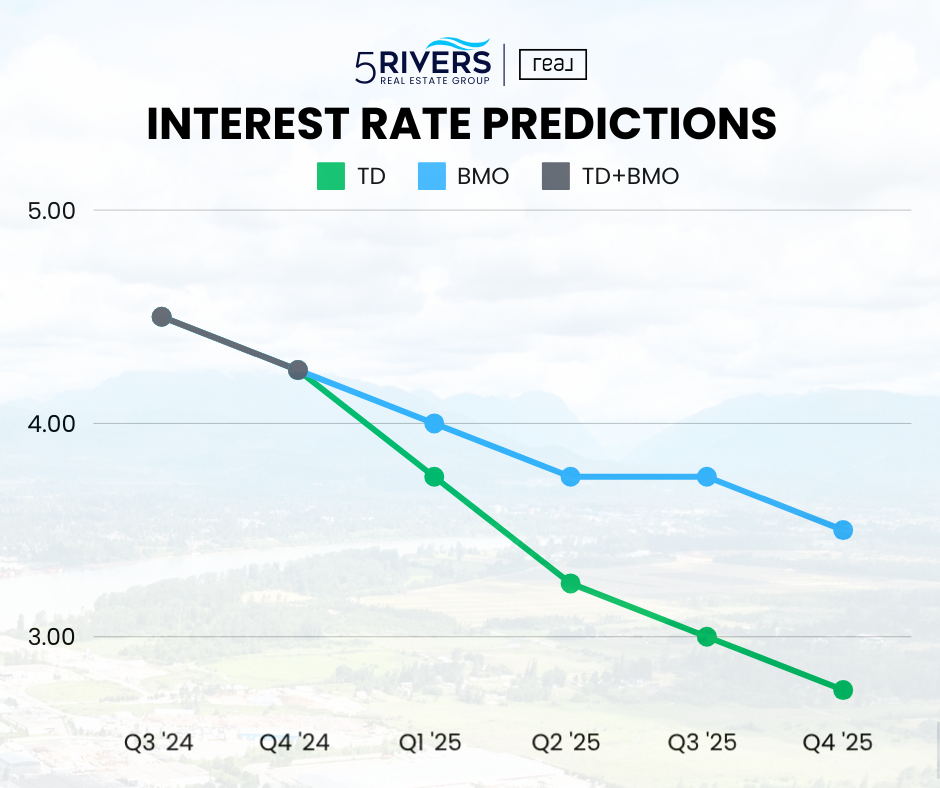

I created a series of graphics, which I shared on social media, comparing interest rate projections from the big five Canadian banks. The graphic here is pulled from that data, which shows the range of the banks, with BMO being more conservative and TD a bit more bullish.

Here are some key takeaways from the big 5 banks:

1) CIBC, RBC, & Scotiabank all predict the prime rate will drop to 4.0% by the end of this year. However, RBC & Scotiabank are thinking that we'll see a quicker drop to 4.25%.

2) TD, CIBC, & RBC project a reduction to 3.0% by the third quarter of 2025.

3) TD & CIBC believe that interest rates will drop as low as 2.75% by the end of 2025. However, BMO is much more conservative, predicting a 3.5% rate.

Regardless of the differences, when every major bank making predictions like this, it's likely that more than a few potential buyers will stay on the sidelines waiting for better rates. The common thought is that lower interest rates not only help keep payments down, but they also help buyers qualify for a larger mortgage. Both of these things can be true, but a significant amount of economic nuance is missed.

When interest rates come down to the point that pushes the typical home buyers to purchase en masse, they often do so after the more savvy real estate investors, speculators and developers. This means that by the time buyers come back to the market to make a difference in these graphs, property values are likely going to be much higher. So although a home buyer can "afford more" (in dollar value) with lower interest rate, they are actually buying less house than they could have at a higher interest rate.

On top of that, when you "give" everyone more money, which is what elevating the increased purchasing power through lower interest rates, what do you believe people do with it? They spend it. In the real estate market, this pushes the prices up further. We have seen this cycle every time that interest rates go down. The same phenomenon occurs when tax rebates are provided in the real estate market. It doesn't make homes more affordable, it just shifts the money around.

So do I believe home buyers are waiting on better interest rates to purchase property? Yes, yes I do. Should they? Maybe, maybe not. This completely depends on your individual situation. What's key is to weigh out as much of the big picture as possible and make a decision that is right for you. What I do know is that "patience" is generally not a virtue in the world of real estate. Indecision or lack of planning can often lead to being swept up in hype, fooled by influencers, or significant loss of opportunity.

I may also be biased, but I generally think its smarter to purchase a long term asset at a lower price with higher interest rates and have those interest rates fall, than it is to wait for interest rates to fall and then purchase at a higher price...

There is No Crystal Ball

The big 5 banks are basing their projections on what the Bank of Canada wants to do with a whole lot of assumptions in stability of the world markets - an assumption that is impossible to take seriously. In my adult lifetime, I've seen 9/11 completely disrupt markets in 2001. I've seen the financial and housing collapse in 2008. I've seen an unheard of housing escalation in 2016. And then finally we have the pandemic of 2020-22 and the Russian invasion of Ukraine, both of which have had immense economic repercussions. None of this was predicted or assumed by big bank projections or central banks. They've all had influence on rise and falls in the real estate markets.

We don't know what the next event to change history will be. Politically, we have a provincial election in October and our neighbours to the south have their Presidential election in November. Both will have an affect on our economy and our markets to varying degrees. There is escalation of war in the Middle East, again. World history continues to play out and our markets react with the same votility they've had for generations.

This may seem like a pretty high level monologue, because its meant to be. It's easy to get caught up in the 40-second reels and 20 second news soundbites. My advise: avoid making decisions based on social media. It's human nature to want to make wise, sound choices, while also mitigating risk. It's also human nature to be fearful and make irrational decisions. We want security and predictability when it comes to our finances. Regardless of what any real estate agent, mortgage broker, or financial advisor tells you, there is no silver bullet. There is no way to make a guaranteed investment that doesn't come with some risk, or way to perfectly time the market. If we could, we would all be Warren Buffet - and even he has made mistakes. However, we should take some advice from one of the most successful investors in the world:

“Risk comes from not knowing what you’re doing.”

-Warren Buffett

A home is more than just a house.

It is the family, the friends, the neighbours, and the overall community that make a place a home.

The 5 Rivers Real Estate Group is dedicated to giving back to the communities we live and work in. We believe that being involved in our local areas builds stronger, healthier, and friendlier neighbourhoods and cities.